The holidays are a joyful occasion for many of us. However, it is also a great opportunity to give thanks for what you have and give back to help those less fortunate. The holidays can be difficult for people experiencing financial difficulties or who may not have a support system to help them, especially right now. However, by donating to an organization helping those in need or giving a little of your time, you can make a big difference in your community and beyond.

Here are just a few ways to give back during this holiday season:

- When shopping at the mall: Many retail stores partner with nonprofit organizations over the holidays to provide shoppers with the opportunity to donate a small amount when purchasing their gifts. Consider rounding up your purchase to the nearest dollar and contributing this amount to the store’s organization of choice.

- When shopping online: A wide variety of online retailers will make a donation for every purchase you make during the holidays, and often throughout the year. However, many websites are now offering the option of designating the organization of your choice. By shopping through a site like Amazon Smile or Goodshop, you can shop at thousands of online retailers, and the site will donate a portion of your purchase price to the organization that you choose.

- By making a donation: In addition to donating while shopping, you can also make a direct contribution to your favorite cause. Collect canned goods for the local food bank, organize a toy drive to support Toys for Tots, sponsor a local family who may need some extra help this year, donate food to the county animal shelter or participate in GW’s Give a Gift event that provides gifts to families around the D.C. area. Anything you can give, either money or resources the organization may need, can make a huge impact for those they help.

- By giving your time: You don’t have to spend or donate money to make a difference. By volunteering an hour or so of your time, you can help make someone’s holidays just a little brighter. While there may be health and safety restrictions in place, there may still be opportunities to help. Reach out to the local food bank or soup kitchen to see if you can help serve a holiday meal or sort through donations; help out at a 5k race for charity; coordinate a group of friends to make care packages for a local senior center; wrap gifts at the mall to raise funds for a local organization; take a shelter dog out for a walk – the opportunities are endless. Think about what you might be interested in doing and reach out to a local organization to see how you can help.

They say that it is better to give than receive, so take a moment (or more!) to give back and provide some much-needed holiday joy to others this year.

Other helpful resources

For more opportunities to give back this holiday season, please visit any of the sites listed below:

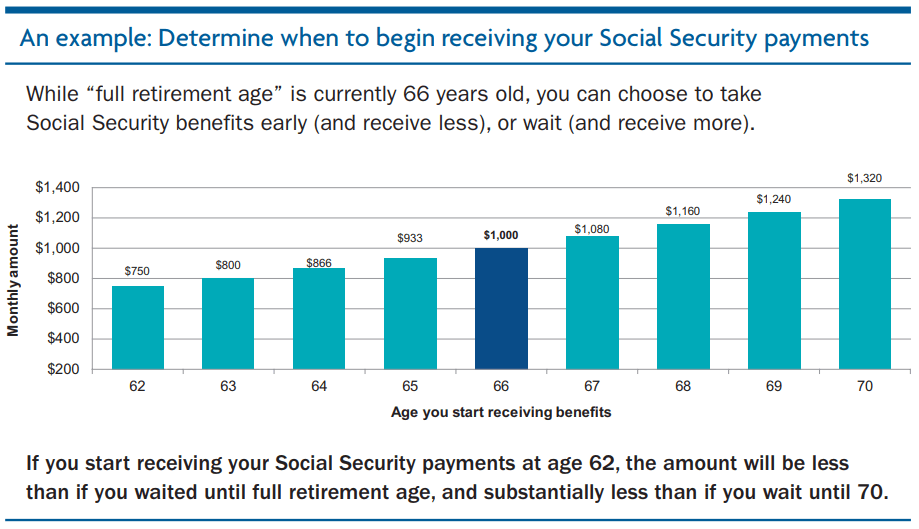

You can also view other Holiday resources related to your financial health and wellbeing this season by visiting Health Advocate, Fidelity, or TIAA websites.