It’s important to recognize how mental health and financial health contribute to our overall wellbeing. During May we want to take a moment to bring awareness to mental health and financial health concerns and provide resources that can assist you in achieving overall wellbeing.

There are multiple challenges to attaining mental and financial wellbeing. The pandemic had a profound impact on the American workforce. With layoffs, inflation and rising costs of everything from gas to housing, money is on the mind of many. Americans are looking for financial stability, independence, and retirement security. In a recent TIAA Retirement Insights Survey, 65% of participants surveyed report an increase in their overall stress since the start of the pandemic1. The report also found 51% of participants are more anxious about being able to afford to retire when they want1.

To help and provide a clear path forward, you also have financial wellbeing resources available to you at TIAA and Fidelity.

Online Tools and Resources:

A cornerstone of GW’s financial wellness focus is to provide tools and resources to help you perform regular self-checkups and have financial consultants available to listen to your needs and goals and work on a path to your future in retirement.

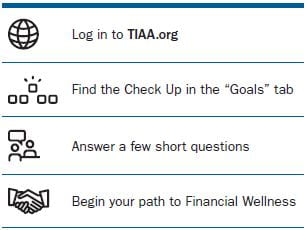

- 6-Minute Check-Up helps to improve your financial wellbeing by providing actionable steps and educational content that you can read at your own pace. You start by answering 10 questions to evaluate your connection to finances and concerns you may have. You will receive a score and an actionable plan with tailored educational content that you can complete and track your progress. Log in to TIAA.org and find the Check-Up in the “GOALS” tab.

Fidelity participant? Financial wellness shouldn’t feel like a balancing act. In under 10 minutes, take the financial wellness checkup, get your scores, and next steps to help improve. Take the Financial Wellness Check up!

- Discuss your financial situation with a TIAA or Fidelity consultant:

- Fidelity Investments – Make an appointment online or call 800-642-7131

- TIAA – Make an appointment online or call 866-843-5640

- Retirement calculators & financial tools that can help you create a budget, calculate your needs for retirement, learn how to invest, and understand how much income you’ll have in retirement. TIAA tools are available at TIAA.org/tools.

1 The 2022 TIAA Retirement Insights Survey was conducted online from Dec. 21, 2021 to Jan. 7, 2022 surveying 1,008 retirement plan participants ages, ages 25 to 70 employed full-time at a company with 50+ employees and participates in a 401(k) or 403(b) plan, and 500 benefit plan decision makers employed full-time at a company with 50+ employees and offers a 401(k) or 403(b) plan.