Many people are staying longer in the workforce to build a large enough nest egg to be comfortable in retirement. The average retirement age has risen steadily since 1985, to almost 65 for men and 62 for women in 2015.

So how can you tell when it’s the best time for you to make the transition from the 9-to-5 to post-career life? The answer depends on your personal and financial goals, the amount you currently have saved for retirement and your confidence in how long your savings will last.

Below, we’ve provided a few other key considerations in your journey to retirement.

1. Social Security

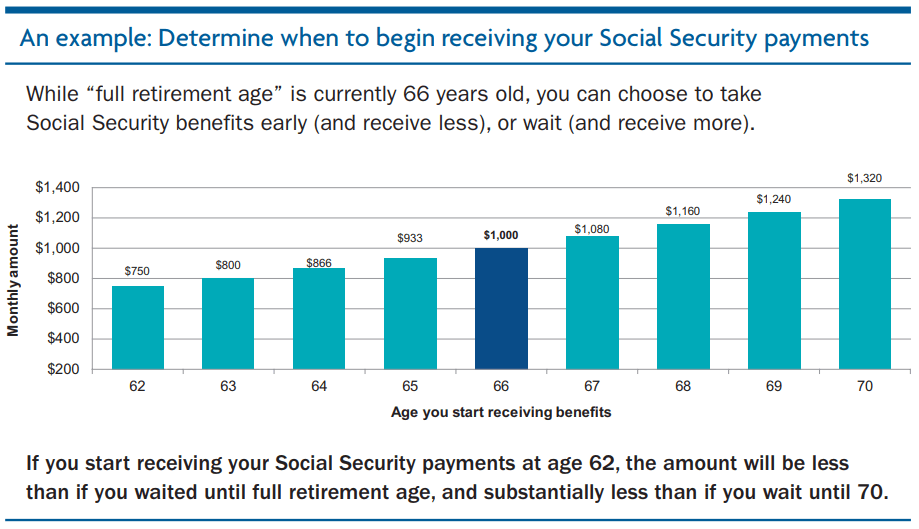

Social Security may be a hefty portion of your retirement income, but the amount you receive can vary significantly depending on when you start taking payments. The “full” retirement age – meaning, the age at which you are eligible to retire with full retirement benefits – is currently 66. However, you may choose to take Social Security benefits early (and receive less), or wait (and receive more).

The following example, provided by TIAA (PDF), assumes a benefit of $1,000 at a full retirement age of 66:

The Social Security Administration website offers a retirement benefits estimator that provides estimates based on your actual Social Security earnings record.

2. Age-specific milestones

Certain tax laws and distribution requirements may affect when you choose to take retirement income. When planning for retirement, you should be aware of the following milestones:

Age 50 – As an active employee, beginning the year you turn age 50, you are eligible to make a “catch-up” contribution of $6,000* to GW’s 403(b) Retirement Plan.

Age 55 – If you participate in the GW Health Savings Plan (HSP) and have a Health Savings Account (HSA), beginning the year you turn age 55, you are eligible to contribute an additional $1,000* HSA catch-up contribution.

Age 59½ – You are eligible for in-service withdrawals from your 403(b) Retirement Plan account and from any matching contribution in your 401(a) Retirement Plan account. Withdrawals are no longer subject to an additional 10 percent early-withdrawal penalty.

Age 62 – Minimum age to begin receiving Social Security benefits at a reduced amount. You are also eligible for in-service withdrawals from any base contributions in your 401(a) Retirement Plan account.

Age 64 and 8 months – You are eligible to apply for Medicare. If you are still working for GW and covered under a GW medical plan, you do not have to enroll in Medicare until you plan to retire (PDF).

Age 66 – You are eligible to receive full Social Security (if you were born between 1943 and 1954); there is no reduction in benefits no matter how much is earned in the future.

Age 70½ – If you are no longer working for GW, you must begin taking Required Minimum Distributions (RMDs) from your 403(b) and 401(a) retirement accounts; otherwise, you will face a 50 percent federal penalty of the difference between what you actually received and the required amount.

*Figures provided are for 2018, and are subject to change.

3. Retirement Spending

According to the latest Bureau of Labor Statistics data (PDF), households run by someone age 65 and older spend an average of $45,756 per year (roughly $3,800 per month).

Retiree spending habits tend to differ from those of the working population. While your spending in retirement will vary as a result of numerous variables, you can start estimating your expenses.

(a) Essential expenses

These include necessities such as groceries, utilities, transportation, housing and healthcare. Healthcare is one of the potentially largest expenses in retirement. Learn how you can save for healthcare in retirement.

(b) Discretionary expenses

Included in this category are “nice-to-haves” such as travel, dining out, hobbies or purchases such as new vehicles and vacation homes.

(c) Emergency expenses

This category includes unexpected events such as a leaking roof or an unforeseen health issue. You should budget for emergency expenses as you plan for retirement; a good rule of thumb is to set aside three to six months’ worth of living expenses in your emergency fund.

Run your numbers. Fidelity and TIAA offer a number of financial tools to help you determine if your retirement plan is on track.

Create a plan and take action. Schedule a free appointment with a Fidelity or TIAA financial consultant to ask questions about your retirement goals and needs, as well as a range of other topics such as budgeting, debt management, investment basics and more.

- Fidelity Investments – Make an appointment online or call (800) 642-7131

- TIAA – Make an appointment online or call (866) 843-5640

Want to learn how to retire from GW? Read our Retirement Planning Guide (PDF), or attend the upcoming VSTC Retirement Education & Financial Wellness Fair.