Last week, we held VC Pitch Day in our Foundations of Venture Capital class, taught by Professor Bill Collier and supported by Teaching Assistant Yaseen Shah. Students have been building their startup companies for the last 15 weeks and were excited to present their work to a panel of esteemed industry professionals. We are grateful to the following judges for their time and feedback:

- Matt Gittleman: Investment Director, JHH vc

- Durriyyah Jackson: Director of Development, The George Washington University

- Scott Lefkowitz: Senior Associate, Las Olas Venture Capital

- Steve Ryan: Partner, Pillsbury Winthrop Shaw Pittman LLP

- Martin Sajon: CEO, Co-founder, DASCalendar

Student teams focused on building product solutions in different industries. Check out their businesses below:

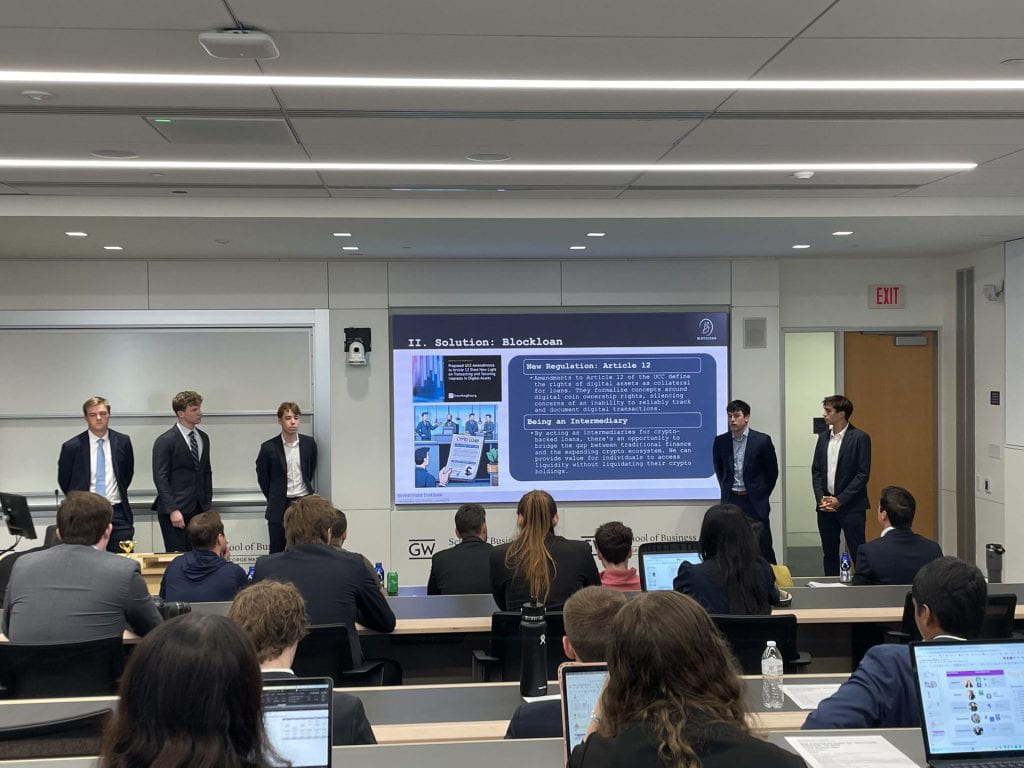

BlockLoan

BlockLoan aims to revolutionize the lending landscape with its innovative platform specializing in digital asset collateralized loans. Our platform provides a centralized space for borrowers and lenders to access funding through digital asset-collateralized loans. BlockLoan aims to democratize access to capital, providing quick and legitimate funding where needed most.

Dispatch

Dispatch is an app-based technology startup based in Washington, DC. The company seeks to provide an intuitive messaging-based platform to facilitate their users’ process of quitting social media.

ElderTech

ElderTech provides a tool for caregivers to record conversations with patients, acting as a passive monitoring platform. ElderTech aids in meeting the physical and emotional needs of patients and alleviating the stress involved with caring for them.

EmitLess

EmitLess is a Software-as-a-Service (SaaS) company that uses advanced artificial intelligence (AI) to address environmental challenges. EmitLess software offers a range of tools that allow urban planners and ecologists to customize the park designs according to specific local conditions and requirements, ensuring optimal functionality and sustainability.

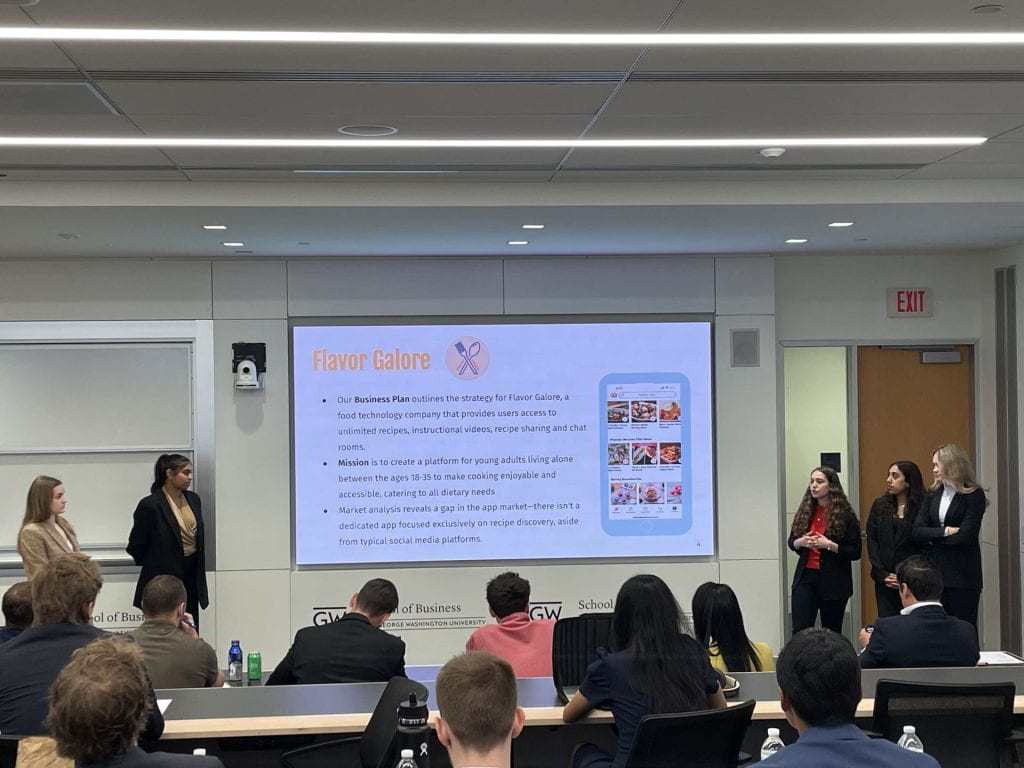

Flavor Galore

Flavor Galore is a cutting-edge social media platform revolutionizing how young adults approach home cooking in solo living. Flavor Galore platform provides comprehensive resources tailored to empower users in their culinary endeavors. It includes an extensive database of recipes, meal planner tools, and a vibrant community where users can share their recipes and engage with like-minded individuals in cuisine-specific groups.

Guardian Solutions

Guardian Solutions is a business-to-business (B2B) software-as-a-service (SaaS) platform that allows automatic GPS-enabled time tracking, recording, and monitoring of employees for retail and construction businesses.

MealMatch

MealMatch is a B2C and B2B Software-as-a-Service company offering a new, innovative search engine for the online food delivery industry. By optimizing how users search for food online, MealMatch aims to put more decision-making power back into the consumers’ hands.

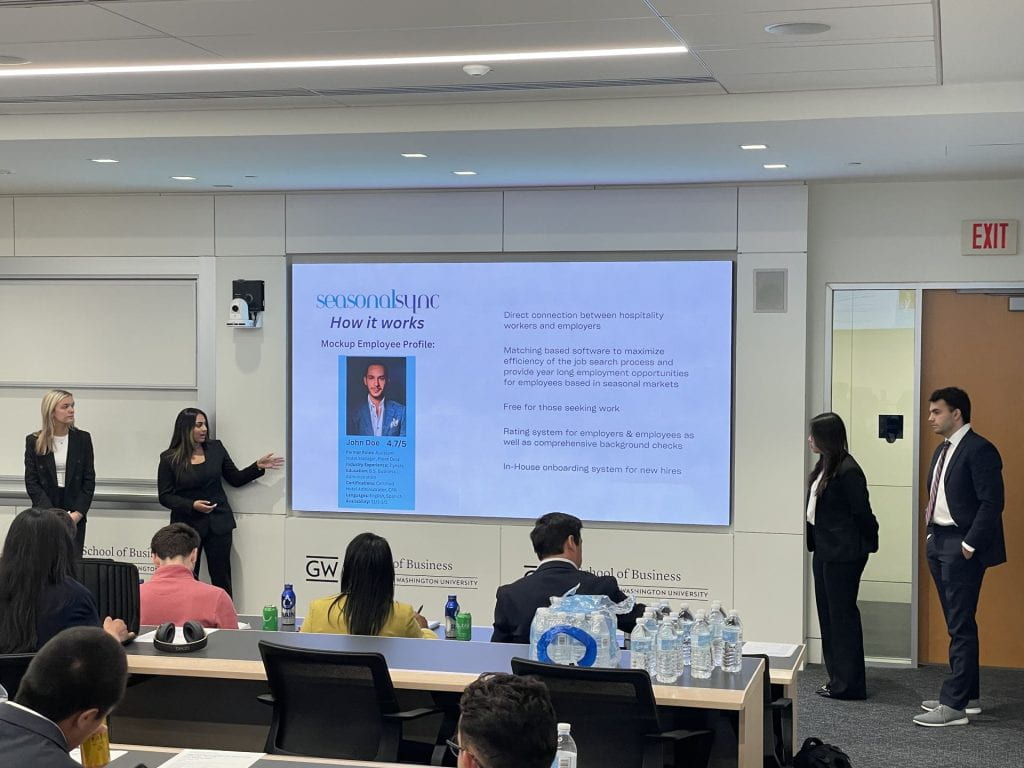

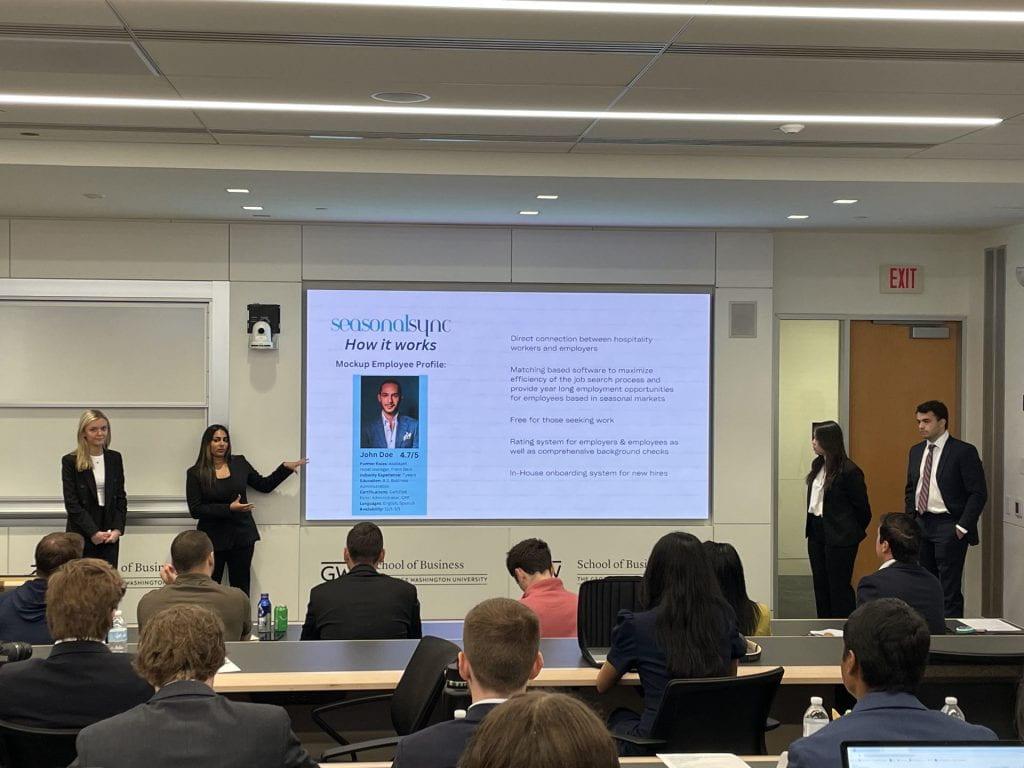

SeasonalSync

Seasonal Sync is a human capital services platform created to connect hospitality employees with employers nationwide via an online matching service. We specialize in seasonal businesses to maximize employment opportunities within the hospitality industry. Seasonal Sync aims to combat the crippling understaffing that plagues the hospitality industry and provide a seamless system of hiring.